You may be aware that tax credit donations to the East Valley JCC help provide preschool and camp scholarships and kosher meals to individuals in need. But did you know that it can also help local synagogues?

Through April 15, an anonymous donor will give an incentive grant of 25 cents per dollar to the donor’s synagogue of choice when people make a new tax credit donation to the East Valley JCC Qualified Charitable Organization. For instance, if somebody makes a new $200 tax credit donation, the synagogue of choice will receive a $50 grant and if the tax credit donation is $400, the synagogue will receive a $100 grant.

This applies to new tax credit donors only and cannot be used in conjunction with any other tax credit appeal.

Individual donors can give up to $400 (up to $800 for couples) and receive a dollar-for-dollar tax credit on their Arizona income tax return. Donors should check with their tax adviser to make sure they are eligible for the tax credit.

Participating synagogues are Temple Beth Sholom of the East Valley, Temple Emanuel of Tempe and Sun Lakes Jewish Congregation. Donors should make sure to use the following links if donating online:

- Temple Beth Sholom:evjcc.org/tbsev

- Temple Emanuel of Tempe:evjcc.org/emanuel

- Sun Lakes Jewish Congregation:evjcc.org/sljc

If donating via check, donors should print one of the following on the memo line of their check, based on which synagogue they would like to receive the grant:

- Tax Credit Code TBSEV

- Tax Credit Code EVJCC

- Tax Credit Code SLJC

Synagogues can determine how they want to use the grants, such as for preschool or camp scholarships.

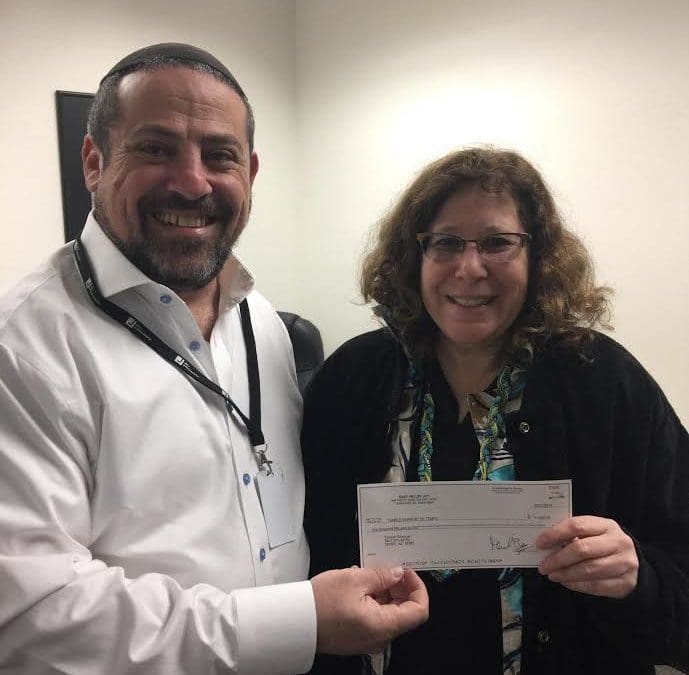

Photo caption: Rabbi Michael Beyo, CEO of the East Valley JCC, presents a check to Gerri Chizeck, managing director of Temple Emanuel of Tempe.